Officials and analysts in Tokyo back president’s attempts to open up economy yet fear midterms may weaken Let’s Change leader’s position

TOKYO — Japan is ready and eager to re-engage with Argentina, with top officials and business experts predicting a sharp rise in trade between the two nations following Mauricio Macri’s first year in office.

In a series of interviews with the Herald in Tokyo and Buenos Aires, officials from the Japanese government and business chambers representing the country’s powerful firms offered President Macri’s attempts to reshape Argentina’s economy strong backing, predicting that bilateral relations between the two nations are entering a new era rife with opportunity.

Japanese officials, diplomats, analysts and business representatives showered praise on the Macri administration, offering strong support for the president’s 180-degree turn in foreign policy from the Kirchnerite era and hailing the president’s desire to open up the economy and reshape Argentina’s business environment.

Yet many of those questioned expressed surprise that the economic turnaround had not been as successful as first predicted, highlighting instability, inflation and macroeconomic conditions. More than once, officials said they were waiting for the government to “deliver on its promises,” and there was concern too that the forthcoming 2017 primaries and midterm elections could lead to fresh instability in the Let’s Change coalition. Japanese officials said they would watch the results closely, in the hope that Macri can sure up his position and solidify his government’s agenda. Many sources told the Herald this week that Japan — and its business community — would simply “wait and see.”

Illustrating the close attention paid to Argentina’s internal affairs, some of those consulted in Tokyo expressed surprise over the departure of Alfonso Prat-Gay, Macri’s former economy minister, who left his post at the turn of the year. Others spoke regularly of the fiscal deficit, feeling it should have been tackled earlier.

Nonetheless, the view on Argentina was overwhelmingly positive, with the country now identified as a key market for Japanese firms in Latin America, as Japan looks to re-engage with the continent after a decade of slowing trade and growing Chinese influence on the continent.

Officials acknowledged that the end of the so-called “Pink Tide” in Latin America, with governments shifting to the right after a string of electoral victories, had opened doors for Japan, laying the groundwork for a new approach to the region, creating favourable conditions and opening up new opportunities for Japanese firms.

The improvement in relations — coming off the back of a decade in which former presidents Néstor Kirchner and Cristina Fernández de Kirchner forged close ties with China, as did a number of left-wing governments in the region — can be seen at the highest level and the two governments are taking steps to deepen their partnership.

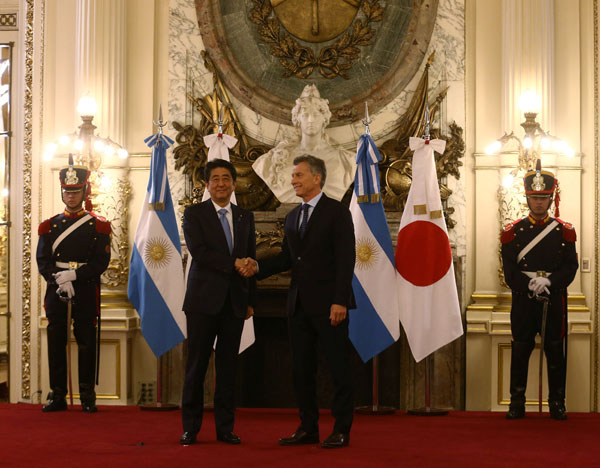

In May, President Macri will visit Japan as part of a two-leg visit also taking in China. That meeting comes off the back of a flurry of engagements between officials from the two nations. In May last year, Vice-President Gabriela Michetti visited Japan, a precursor to Japanese Prime Minister Shinzo Abe’s visit here last November.

Abe was accompanied to Buenos Aires by a number of top officials, business executives and support organisations, including the influential Japan External Trade Organisation (JETRO) and representatives from Mitsubishi, Bank of Tokyo, Toyota, Honda, Mitsui, NEC, the Marubeni Corporation and Nippon Signal.

During that trip, Abe heaped praise on his Argentine counterpart, “highly commending” Macri’s “active steps” in transforming the country and branding his leadership “extremely important” for the wider region. The Japanese Prime Minister said he “strongly supported” Macri’s policies and formalised his backing in a joint statement with President Macri.

The Argentine leader, in turn, called Japan a “priority country” and praised the Asian country’s business community and its progress on “investment and loans.” Both parties agreed to look toward new opportunities and said they would push to remove obstacles barring the entry of fresh Argentine beef and fruits to Japan.

‘Golden years’

Japan’s current ambassador to Argentina, Mr Noriteru Fukushima, is in a good position to judge the new attitude between the two nations. Now restored back in Buenos Aires after an earlier, lengthy stint here in the 1990s, Fukushima has extensive diplomatic experience across Latin America. Eighteen months ago, he returned to Argentina as the tide turned for Japanese firms. He predicts big things are on the cards.

“The next three (years) are the ‘golden years’ and we must utilise and make the most of the oppotunities,” the ambassador told the Herald this week, citing the growing strength of bilateral relations, as evidenced by Prime Minister Abe’s visit to Buenos Aires, President Macri’s upcoming trip to Asia and next year’s G20 summit.

“We have the two governments’ goodwill to move forward,” he added.

From Toyko, Argentina’s Ambassador to Japan Alan Beraud said he was in full agreement. He confirmed that his Embassy had been tasked with encouraging the Japanese business community to explore investment opportunities in Argentina and expressed his opinion that improved relations with Japan would deliver a clear sign to the rest of the global business community that Argentina was back on track.

“We are trying to work and (we are) improving a lot, working with the political momentum … and it’s happening,” said Ambassador Beraud. “(But) we are starting from a modification of our traditional relationship with the Asian countries. We had moved toward China (under the previous government), and focused on China, in a way that other countries had been left aside.”

For Beraud — who assumed his position last April — the government’s charm offensive on Japan is a move that refreshes longstanding diplomatic ties.

“Japan was one of the traditional partners of Argentina for a long time,” he continued, confirming that the Asian giant was a “priority country” for the new government. “But this doesn’t mean the other newcomers, the new partners have to be avoided!”

Longstanding ties

Indeed, Japan’s engagement with the wider continent is historical. Relations between Japan and Latin America date back to the late 19th century, when settlers from Asia first arrived to remote Amazonian outposts. While the vast majority of immigrants settled nearby Brazil and Peru, Japanese people arrived to Argentina in the form of labourers. Today, the Nikkei community in Argentina (Japanese emigrants and their descendants who formed communities in foreign lands) is more than 23,000-strong, according to statistics from the Association of Nikkei and Japanese abroad.

Now, aided by EPAs with Mexico, Chile and Peru and its observer status with the Pacific Alliance, Japan is looking fondly toward Latin America once more. In 2015, trade with the continent totalled more than US$44 billion and with a more favourable political climate for the Japanese government, this figure looks set to grow even further. Prime Minister Abe has extolled his hunger to deal more with the continent, declaring a “vigourous march forward” was in the sights during a speech in São Paulo in 2014 and upgrading Argentina to a “strategic partner” during his joint press conference with Macri in Buenos Aires last year.

In the 1990s, a high of 120 Japanese firms were operating in Argentina. That figure slumped to as low as 54 at the end of the Kirchner years. But in the last year and a half, things have picked up, with 78 companies from Japan currently in operation here.

Ambassador Fukushima is aiming higher. “There should be more than 200, even 300,” he told the Herald this week.

A JETRO-led consultation carried out last year found that Japanese firms already in Argentina had a generally positive outlook on the business environment. Thirteen percent of firms based in Argentina who responded said they had increased their number of employees over the next year, while 21.7 percent expected to increase hirings next year — the third-highest in the continent after Mexico and Colombia. For Latin America in general, 14 percent of Japanese firms based in the region expected the same. Forty-three percent of Japanese firms in Argentina, meanwhile, said they expected to increase hirings of domestic employees in the coming year too, compared to 26 percent the year before.

But while those numbers should cheer the Macri administration, the government needs assistance sooner rather than later. Ambassador Fukushima, while pointing out that macroeconomic conditions still need to improve, acknowledged the lack of “concrete projects” in the works.

How “concrete” the promises of investment are is an interesting question. President Macri has faced criticism from some corners, who accuse him of overplaying promises of investment. So what’s the reality of the situation today?

Since December, investment from Japan totalling US$1.2 billion has been announced, Ambassador Fukushima confirmed this week, with the largest amount, some US$600 million stemming from the automobile giant Nissan, which will begin production on a new pick-up in Córdoba from next year, with targets aimed at 70,000 units. That, the ambassador believes, is a clear sign that Japanese firms are ready to do business here again.

But are Argentine firms as interested in Japan? In two separate meetings, representatives from the Japan-Argentina Business Cooperation Committee and the Japan Assocation of Latin America and the Caribbean (AJALAC) told the Herald that while discussions between companies from the two countries were fruitful and productive, there needed to be a stronger commitment from larger Argentine firms to bilateral meetings. AJALAC members commented that business-to-business summits such as the Japan-Argentina committee often involved executives from huge Japanese firms such as Mitsubishi and Toyota, yet their Argentine peers represented smaller firms that operated on a different scale.

Security and stability

The most key issue at hand for Japanese firms it seems is security and long-term viability of any investment. Multiple sources consulted by the Herald in recent weeks acknowledged that while there were a considerable number of projects that were intriguing in Argentina — including projects related to infrastructure — many could not be “guaranteed” by the national government, meaning Japanese banks were unwilling to back them, with Argentina’s reputation for economic instability preceeding it. The “stability” of the Macri administration was regularly mentioned as a key consideration too as, inevitably, was inflation.

Representatives from AJALAC — whose leadership is composed of ex-business executives, academics and former diplomats with extenstive experience of terms in Latin America, said that the Argentine government’s efforts were set against a backdrop of years of neglect, unlike other nations in region.

There were “big opportunities” in Argentina, the leadership agreed — pointing to examples such as the Vaca Muerta shale formation in the north of the country — and though the government is important, any outreach needed to be backed by firms itself and the conditions for investment, naturally, were keen. While they backed Macri, they said, there was no proof that his political project would continue, only his desire to reshape the economy.

In Brazil for example, they said Japan had been involved in huge projects under multiple governments, including the Workers’ Party (PT) administrations led by Luiz Inácio Lula da Silva and Dilma Rousseff. The government was important, they said, but willingness must come from other areas too.

“Other than (President) Macri, we don’t have any other partner (in Argentina),” said Executive Director Akira Kudo, “The Argentine partners don’t consider Japan as much.”

Fukushima, echoing the words of business lobbies and chambers consulted by the Herald in Tokyo earlier this month, stressed the importance of a bilateral investment treaty, calling it “an important symbol.” The treaty was brought up time-and-time again by specialists and its signing would help convince Japanese firms that the conditions were in place. Negotiations are ongoing, with the Macri administration said to be keen on signing the deal during his trip to Tokyo. Sources told the Herald that, however, there were still issues that need to be resolved. The signing, they said, would likely come a month or two later than that.

Yasushi Takase, the director-general of the Latin American and Caribbean Affairs Bureau at Japan’s Ministry of Foreign Affairs, told the Herald that while Japanese firms were financially prudent, taking time to decide on an investment, they were committed once a decision had been made.

“In the case of Japanese firms, we have a good reputation that when we say we’re in, we’re in,” said Takase. “It’s easier for us to deal with (them). It’s true,” he said. “Especially with President Macri’s government, now they have more interest in international affairs too.

“The former government, in terms of diplomacy, was a bit ideological. Now, they’re more neutral, modest… it’s easier for us to talk to them too.,” he added. “Many, many businesses are interested in the new Argentina,” he confirmed.

The diplomatic willingness is there, on both sides, to enrich and deepen the ties between Japan and Argentina. But while those ties are obviously important, it will not be Prime Minister Abe or President Macri who will put their company’s cash on the line. It is the firms themselves who will decide how deep the relations between the two countries will truly go. This year’s midterms and the state of the economy look set to be the biggest influence on that in the coming months and years.

@URLgoeshere

This article was originally published in the Buenos Aires Herald, on Friday, February 24, 2017.